capital gains tax increase news

NewsNow aims to be the worlds most accurate and comprehensive Capital Gains Tax news aggregator bringing you the latest headlines automatically and continuously 247. It was said in the report that the government may change the capital gains tax to increase the revenue collections.

Any Gain That Arises From The Sale Of A Capital Asset Is A Capital Gain This Gain Or Profit Is Comes Under Th Capital Gains Tax Capital Gain Financial Peace

Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently.

. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. Proposed capital gains tax. Capital Gains Tax News.

Recently news was also published in Mint that the government is considering to increase the capital gains tax. March 26 2022 229 PM PDT. Republicans waging war against President Bidens proposed tax increases are increasingly focusing their opposition on one floated change to capital gains.

The Biden administration has proposed an increase in the current favorable capital gain rates for people earning more than 1 million. To provide the most recent info on capital gains taxes weve collected data. Capital gains tax rates on most assets held for a year or less correspond to.

The Biden administration recently released plans to increase the top capital gains tax rate for people earning over a million dollars a year to help pay for his American Families Plan. Above that amount you are now in the 15 ltcg tax bracket and pay 15. Biden proposes nearly doubling the long-term capital gains tax rate for households with more than 1 million in income from its current 20 percent to 396 percent the same rate that they would pay under his plan on wages earned from working.

Relevance is automatically assessed so some. President Joe Biden will propose a minimum 20 tax rate that would hit both the income and unrealized capital gains of US. Tax rates generally increase when your income.

NewsNow brings you the latest news from the worlds most trusted sources on Capital Gains Tax. The actual rates didnt change for. Under the proposed Build Back Better Act the top marginal tax rates will jump from 20 to 396 That is.

Thats the Greenlight effect. Capital gains tax The Democrat-led state Legislature approved a 7 tax on capital gains over 250000 early in the year. In the state of Washington the governor has proposed a capital gains tax that could raise almost 1 billion if passed.

To increase their effective tax rate to 20 percent the household must remit an additional 12 million in tax 3 million in taxes paid with a 15 million income inclusive of unrealized gains. Capital gains will count toward your adjusted gross income for tax purposes. However later the Finance Ministry denied this news.

The rate could be as high as 396 matching the top ordinary income tax rate before the Tax Cuts and Jobs Act TCJA. Households worth more than 100 million as. The underlying tax proposal is a hike in the capital gains tax from a top rate currently of 238 percent to 434 percent which is set to.

Capital Gains Tax Rate Update for 2021. So a big capital gain can push. Ad The money app for families.

While it technically takes effect at the start of. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Download the app today.

Discussion on raising capital gains tax. With all 76 members of the legislature up for reelection lawmakers are expected to shy away from those potentially controversial tax measures this year.

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Your Queries Income Tax Capital Gain On Sale Of Inherited Property Is Liable To Income Tax The Financial Express

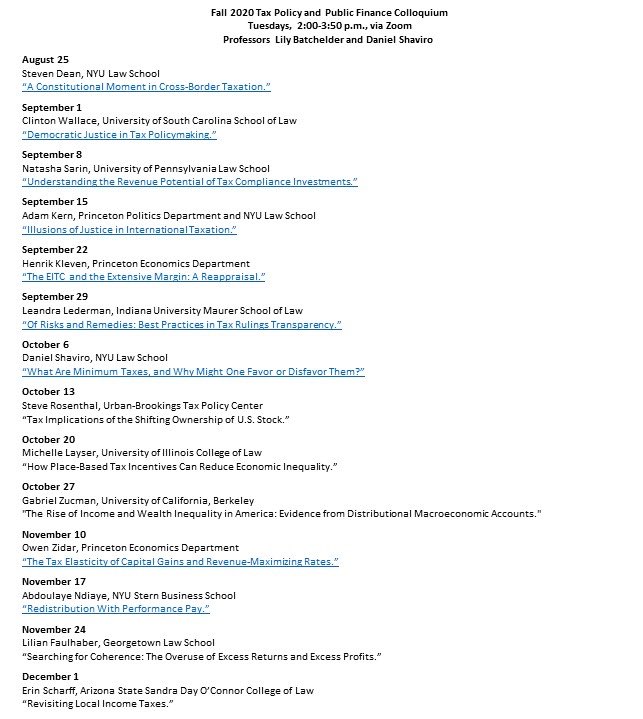

Lily Batchelder Lilybatch Twitter

How Does The Personal Representative Deal With The Income And Capital Gains Arising After The Deceased S Death Low Incomes Tax Reform Group

Pin By Nawaponrath Asavathanachart On 1945 Capital Gains Tax Germany And Italy Capital Gain

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Taxation In Australia Wikipedia

Capital Gains Capital Gain Accounting Education Bookkeeping And Accounting

Capital Gains Definition 2021 Tax Rates And Examples

Taxation In Australia Wikipedia

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/business-office-entrepreneur-professional-551db58768a445298e0760a6c2e7184e.jpg)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)